Liberty Oilfield Services, Inc. (NYSE:LBRT) tested the resistance level of $17.50 this week after hitting the highest price of $20.05. Though the stock has since then retreated to $17.38, the price movements point to a market that is highly bullish. This analysis considers whether investors should buy into the company which henceforth will be called Liberty Energy.

Liberty beat earnings expectations after recording a net loss of $0.03 per share against the expectation of a wider loss of $0.16 per share. This comes as the stock continues to record increased activity. Gains in oil prices in the global markets have been a key factor for the company, which now expects a further 10% growth in revenues.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

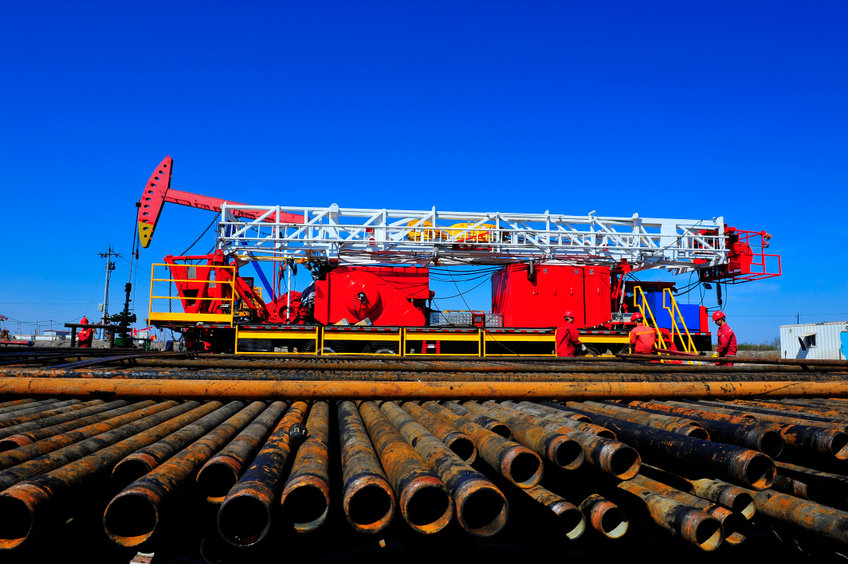

The company continues to benefit from the growing prices of oil and gas. This results in increased demand for oilfield services. Liberty recently announced that it would not be making new fracking equipment. The move creates potential supply challenges that are likely to result in growth in the company’s revenues. The company considers this as its strategy for balanced growth.

Liberty tests a new high of $20.05

Analysis of the share price indicates a strong bullish sentiment after the stock tested a new high of $20.05. This is after breaking through the resistance level of $17.50. However, there is something suspicious about the price movement. Traders may have been trying to influence the markets by offering higher prices. The fact that the price pulled back to levels below the resistance level is an indication that it is not yet time for the stock to break out. If the next earnings call demonstrates high growth in earnings, then the stock will move to a new high.

Summary

Liberty Energy beat analyst projections with earnings showing losses declining to $0.03 per share. The stock is trading just below the resistance of $17.50 after testing a new high this week. Considering growth potential, Liberty is a buy, but investors should snap it lower after the current retracement.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- bitFlyer, simple, easy to use and regulated. Register here >

*Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.