Shares of Apple Inc (NASDAQ: AAPL) are up more than 50% over the past year but nearly halfway into 2021 and some investors are convinced a repeat performance won’t be seen. Apple stock is down 3.6% since the start of the year despite an April earnings report that smashed expectations.

Has shares of the iPhone maker reached its peak? Perhaps.

Cathie Wood prefers Coinbase stock over Apple stock

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Stock picking pro-Cathie Wood of Ark Investment Management was a net seller of Apple stock this week. The ARK Fintech Innovation ETF (NYSE: ARKF) cashed in on nearly $25 million worth of Apple stock on Monday and the fund now holds a mere 3,000 share position in Apple.

Wood explained on Bloomberg TV why there is little room for Apple stock in her innovation-focused fund. Wood said Apple is certainly in the “innovation zone†and is a “great†company but she is more interested in finding “the next FAANGs.†At a time when Apple’s stock is stagnating, ARK’s capital can generate superior returns in more innovative names.

One name that Wood is banking on is Coinbase Global Inc (NASDAQ: COIN). In fact, at the same time that Wood was selling Apple stock she was a buyer of more than 160,000 Coinbase shares this week.

Wood’s long-term $500,000 price target for Bitcoin was reiterated on Bloomberg TV. Clearly, she is putting money where her mouth is and betting that exposure to the cryptocurrency space via Coinbase is far superior to betting on Apple’s 5G super cycle.

CNBC’s Faber questions Apple’s identity

CNBC commentator David Faber questioned Apple’s vision and identity Wednesday morning. Most notably, Apple entered the streaming video space in 2019 and has seen small-scale success with a few viral shows.

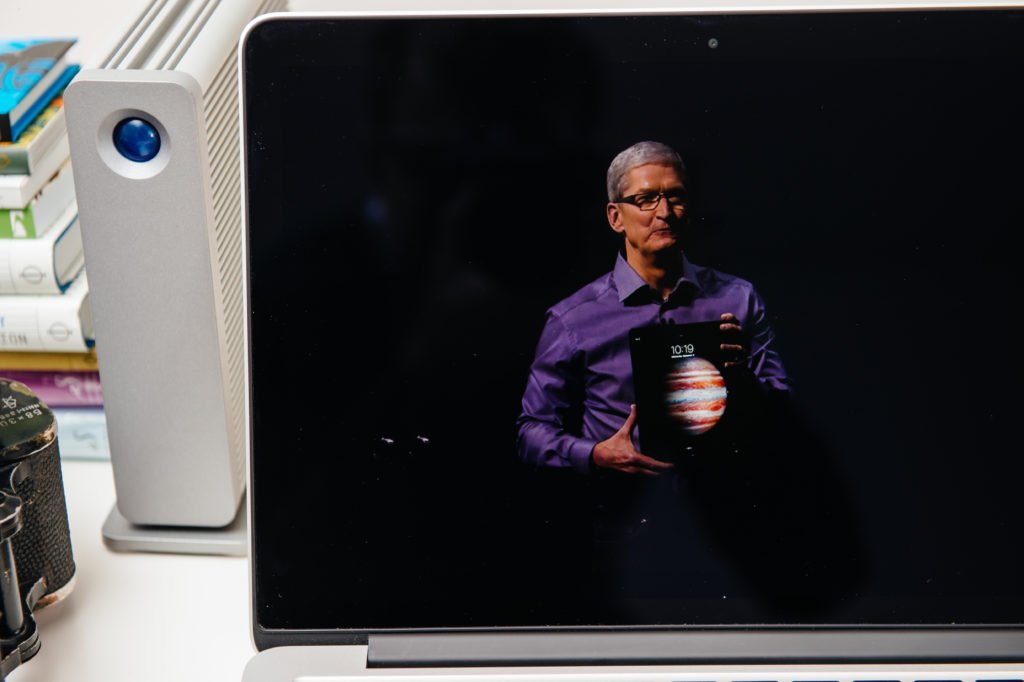

But at a time when nearly every media giant is betting big on streaming video and content, Faber asks “what is the plan†for Apple. Faber, a well-connected corporate insider, noted Apple held talks with several media companies over the years to bolster its library but Apple CEO Tim Cook expressed “no interest†in large scale deals.

While Apple may be dazed and confused over its streaming ambitions, Faber noted that Jefferies analysts initiated coverage of streaming video giant Netflix Inc (NASDAQ: NFLX) with an “Outperform†rating and a price of $620 that implies healthy upside from current levels.

The analysts said in their report that Netflix is in a position to produce content that “rivals the entire TV/Movie industry combined.â€

Apple shareholders may have been hoping the company would be crowned best-in-breed status in the entertainment space. This may no longer be the case and it is unclear how Apple will proceed.

“This is consuming some capital, this is taking up some space — what’s the plan,†Faber said.