The Lloyds (LON: LLOY) share price rocketed higher as investors reflected on the bank’s quarterly earnings and the latest budget by Rishi Sunak. The stock rose to the important resistance level at 50p on Thursday, bringing the gains from September 9th to more than 20%.

Lloyds earnings review

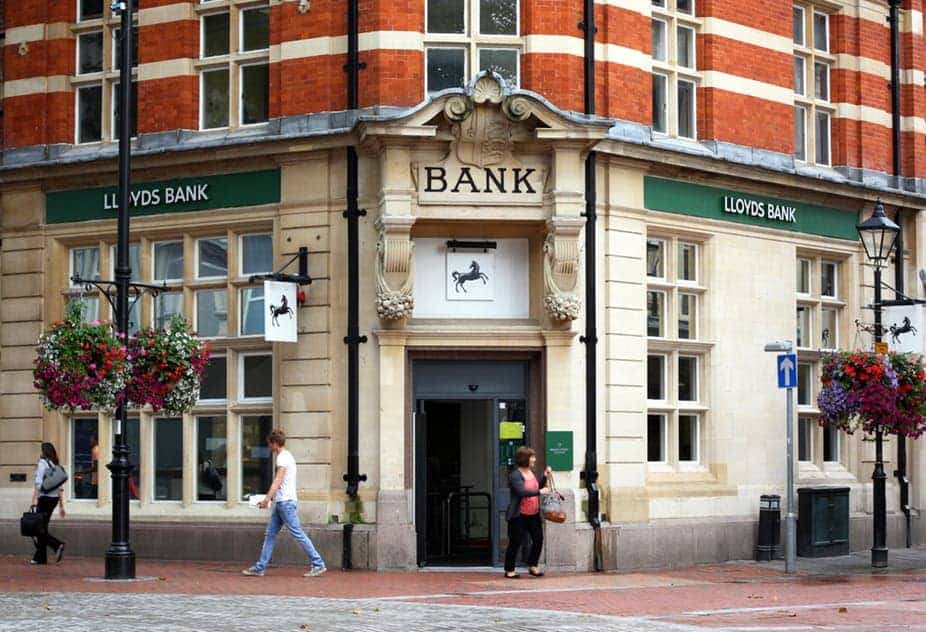

Lloyds Bank is the biggest mortgage lender in the United Kingdom. As such, the company has benefited substantially as the housing sector has done well in the UK. In the past few months, demand for homes has jumped sharply. This has led to substantially higher home prices. Indeed, home prices have jumped by more than 20,000 pounds during the Covid-19 pandemic.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

In its earnings report on Thursday, Lloyds said that its mortgage lending business rose by more than 15.3 billion pounds in the 9 months to September this year. This growth pushed the bank to make a profit of more than 2 billion pounds in the September quarter. This was a better performance than the 1 billion pounds profit it made in the same quarter in 2020.

The report was also better than what analysts were expecting. The median estimate was about 1.3 billion pounds. The profitability was also because of the large amount of money the bank allocated to bad loans last year. It released another 84 million pounds of these funds.

The LLoyds share price, therefore, rose as investors braced for better returns by the bank. Ina statement, the CEO said:

“Building on the strengths of the group and its achievements in recent years, there are clearly significant opportunities for Lloyds Banking Group to further develop its platforms and capabilities and grow through disciplined investment.â€

The “disciplined investment†he talked about was likely the bank’s move into the lucrative wealth management industry. The bank has also unveiled plans to become a major landlord in the UK.

Lloyds share price forecast

In my note about the LLOY share price earlier this week, I noted that the stock would likely keep rising i the near term. That prediction was spot-on as the shares maintained a bullish momentum. Now, the stock has completed the formation of the cup section of the cup and handle pattern. It has also moved above the key 25-day and 50-day moving averages.

Therefore, there is a likelihood that the Lloyds stock price will keep rising as bulls target the key resistance level at 55p.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >