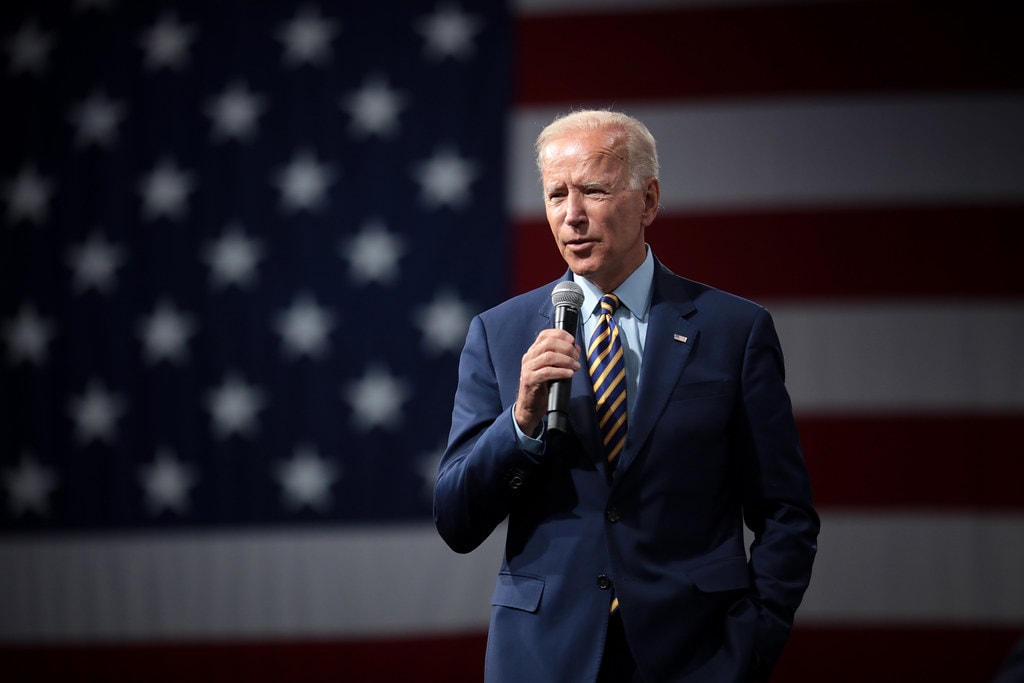

Transportation might be the next big investment theme in the US as the Senate works to enact President Biden’s proposed $579 billion infrastructure bill. The bill seeks to put more cash into telecommunication, utilities, and transportation industries, and according to Global X research and strategy head Jay Jacobs, investors are reacting to this favorably.

Infrastructure investment attracting more investors

In an interview with CNBC’s ETF Edge, Jacobs said:

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

People are very focused on playing the Biden administration because there’s a lot of money coming out of the federal government right now looking for places to invest, and mostly, that’s in infrastructure.

He added:

“There’s $579 billion infrastructure package that could be passed any day now by Congress, but there’s a lot of money really pushing towards this new era of transportation, using electric vehicles, using different clean tech and really advancing infrastructure in the United States.â€

Notably, 3% of the car sales in the US for May and June were electric vehicles which is a higher than usual rate. Electric car companies are leading the transportation industry transformation into the future. For instance, automakers such as BMW, Volkswagen, and Mercedes are doubling down on EV manufacture, and according to Jacobs, this spells a considerable shift in driving trends.

Most importantly, at Global X, the situation has turned into around $4B of inflows for the research firm’s top ETFs, including Global X Lithium & Battery Tech (NYSE: LIT) and Global X US Infrastructure Development (NYSE: PAVE) Infrastructure Development ETF (PAVE). So far, the ETFs have collectively accumulated almost $4 billion in assets in 2021, with each having total assets worth around $4 billion. Jacobs explained that looking at how the ETFs are performing means there is a massive investor appetite for the segment in the market.

Pure tech stocks are not right

He told CNBC:

“Well, I think what’s interesting is that the kind of pure technology stocks are not necessarily what’s in right now. You know, we think of cloud computing and we think of, you know, video games or e-commerce some of those tech names are really popular during the stay-at-home economy. It has kind of shifted away from that more towards what I would call kind of like tech, transportation stocks.â€

Currently, there is a significant transformation going on in the transportation sector, and as a result, investors are warming up to that prospect.

eToro

10/10

67% of retail CFD accounts lose money