Japan Exchange Group (JPX), the Tokyo Stock Exchange and Osaka Exchange owner, warned the public against companies that are misleading Japanese investors by selling crypto assets under the JPX brand.

JPX issued the alert after receiving reports about an ongoing attempt to dupe unwary investors into trading Bitcoin (BTC) and cryptocurrencies on platforms misrepresented as JPX or one of its subsidiaries.

Alert on trading in crypto assets using similar names to JPXhttps://t.co/CVrvpA0dNE

— Japan Exchange Group EN (@JPX_official_EN) February 8, 2022

The company highlighted that the fraudulent companies in question are replicating JPX names, logos and URLs in various forms — including interactions of JPEX, jpex and Japan Exchange — on their platforms and marketing initiatives. JPX’s alert noted:

“Be aware that the above companies and trades have no association whatsoever with Japan Exchange Group, Inc. (JPX) or any other companies affiliated with JPX Group.â€

While JPX has not yet opened up crypto trading for Japanese investors, the company is currently spearheading numerous initiatives to test blockchain and distributed ledger technology (DLT) within traditional finance.

According to JPX, the above initiative aims to improve the transparency of data and the efficiency of data collection via blockchain technology. Moreover, the company, along with 33 Japanese financial institutions, has begun testing and research to discuss the possibility of applying blockchain or DLT to its existing capital market infrastructure.

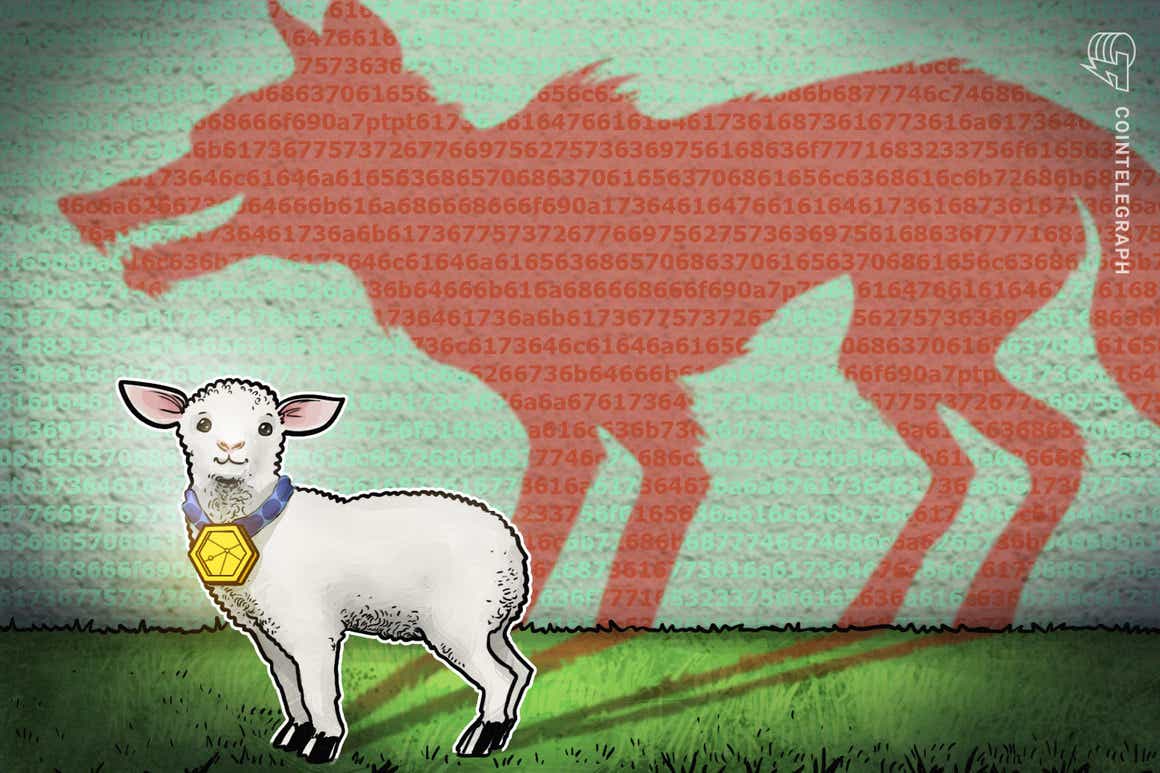

Reiterating JPX’s latest alert, a recent Cointelegraph report from Feb. 17 highlights the rise of new crypto projects that pose as prominent brands to lure investors.

%100scam because mgass=minitesla telegram page

— niyazi kabakçı (@KabakciNiyazi) January 24, 2022

By mimicking popular brands such as Tesla, Jurassic Park, Meta and Animoca Brands, bad actors try to earn credibility for their projects despite having no affiliation with the brands themselves.

Related: Japanese government considers relaxing strict coin listing rules

Japan’s plan for crypto adoption is reciprocated by the sudden rise in the efforts to scam new investors. Earlier this month, the Japanese government reportedly planned out a proposal to make it easier for registered crypto exchanges to list digital assets in the local retail trading market.

As Cointelegraph reported, if the proposal passes, exchanges registered with the Financial Services Agency (FSA) will have the permission to list certain assets without performing a lengthy screening process.