The Poshmark (NASDAQ: POSH) stock price has been under intense pressure ahead of earnings. The stock traded at $35 on Monday ahead of the company’s third earnings release as a publicly traded company. It has declined by more than 66% from its all-time high.

Poshmark earnings preview

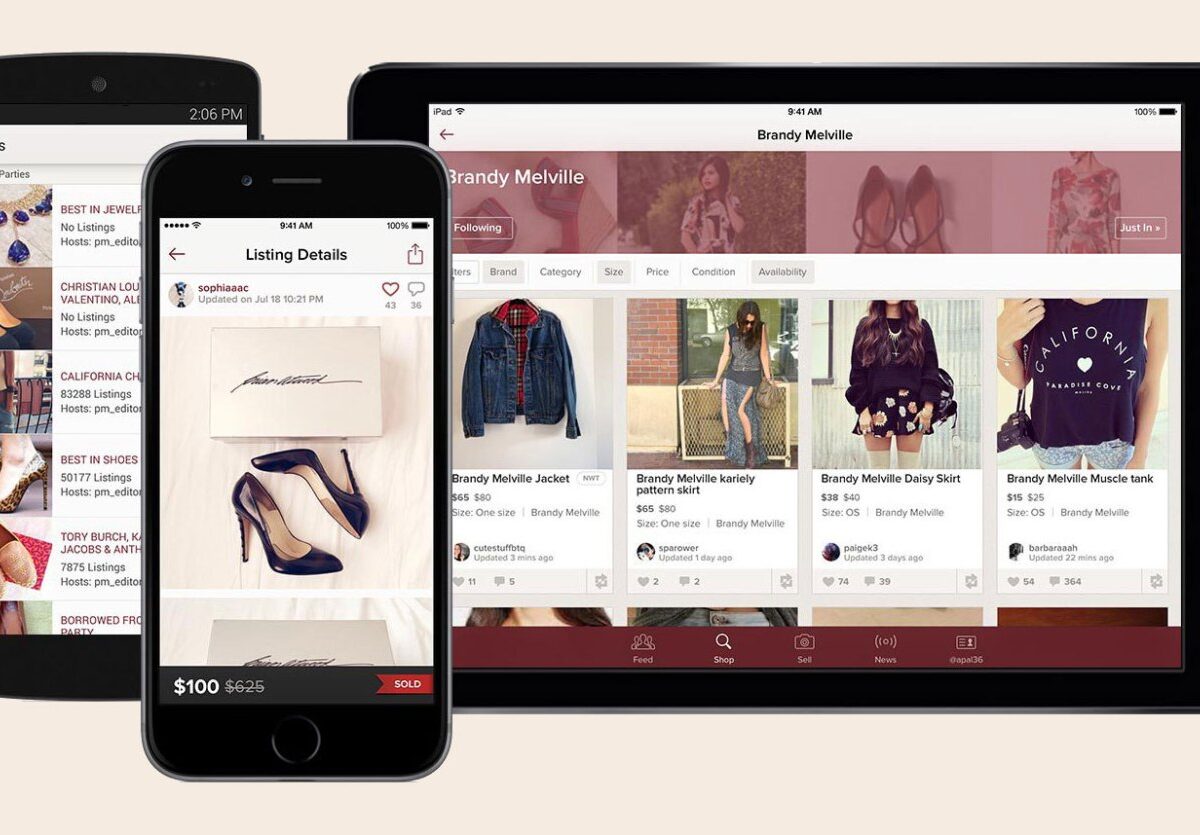

Poshmark is a leading e-commerce company that allows people to buy and sell clothes, accessories, home decor, and beauty products. The company operates at the intersection of the shift to online shopping, social, and second-hand items. The firm went public in January, pricing its offering at $42 per share, which valued the company at more than $3 billion.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Poshmark is in a growth phase where it is focusing on four main things. It is focusing on innovation to boost its growth strategy. Its initial strategy is to grow its video business. The firm is also growing its international business. It has already entered the Indian and Australian markets. Further, it is expanding its categories and is delivering a robust seller platform.

Poshmark will publish its quarterly results on Tuesday after the market closes. Analysts expect that the company’s revenue dropped from $80.96 million in the first quarter to $80.33 in the second quarter. It is also expected to improve its profitability, with its loss per share set to narrow from 33 cents to 7 cents. Still, the firm will likely beat the consensus view as it has done in the past two quarters. Its first-quarter revenue was a 42% year-on-year growth rate.

The Poshmark stock price will react to the company’s earnings and forward guidance. In the previous quarter, the firm guided to Q2 revenues coming in between $79 million and $81 million. It also guided to an EBITDA of between $1.5 million and $2.5 million. Analysts will also be looking at the company’s stock-based compensation, which rose to more than $24 million in the first quarter.

Poshmark stock price analysis

The four-hour chart shows that the Poshmark stock has been in a deep downward dive lately. Along the way, the stock has moved below the 25-day and 15-day moving averages. It has also formed a descending channel pattern that is shown in blue. It is currently at the lower side of this channel. Therefore, there is a possibility that the stock will rebound to the upper side of the channel at around $40 after earnings.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Capital.com, simple, easy to use and regulated. Register here >