The Carvana (NYSE: CVNA) stock price retreated in premarket trading after analysts at JP Morgan downgraded the company. The stock fell to $308 from the Tuesday’s close of $313, bringing its total market capitalisation to more than £37 billion ($53 billion).

JP Morgan downgrades Carvana

Carvana has grown from a relatively small company to one of the biggest players in the auto sector. Its market capitalisation is bigger than that of AutoNation, Carmax, and Penske Automotive, combined.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

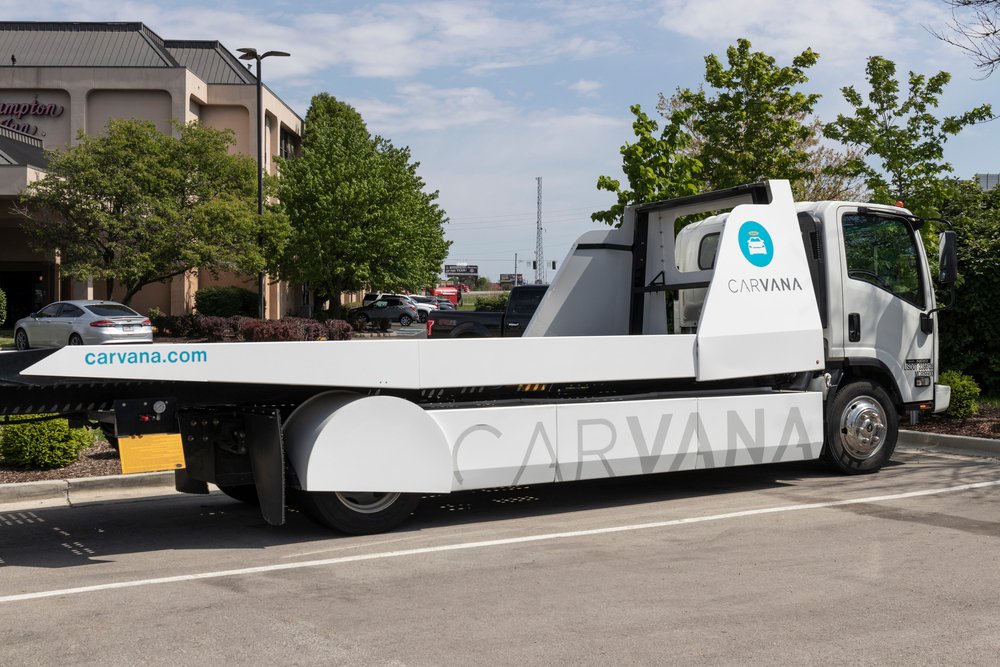

The company makes it relatively easy for people to buy used cars. Customers buy a car through its mobile application or website and collect it at one of its several vending machines. Alternatively, the company can deliver it to them.

This business model has been relatively popular among customers especially during the pandemic. The firm has grown its annual revenue from more than $365 million in 2016 to more than $6.7 billion in the past 12 months.

Carvana’s revenue continued to grow this year. Its revenue grew by 104% year-on-year while its GPU rose by more than $1,000. Carvana sold more than 92,457 cars in the first quarter, an increase of 76%.

This growth has made Carvana relatively popular among investors as its share price has jumped by more than 22% this year and by more than 2,600% since becoming a public company.

The Carvana stock price is falling on Wednesday after analysts at JP Morgan downgraded the stock. In a note, Rajat Gupta said that the stock had reached a near term top. He said that investors will likely find value elsewhere.

Still, other analysts are bullish on the CVNA stock. Recently, analysts at RBC Capital Markets mentioned Carvana as their top pick. The analysts set their initial target at $300, which is below the current $308. Those at Baird boosted the stock to outperform with a target of $335 while those at Citigroup expect the shares to rise to $375.

Carvana stock price forecast

The daily chart shows that the CVNA stock price surged to an all-time high of $322.96 in March. It then retreated by more than 32% to a low of $219 in May as the rotation from lockdown to reopening stocks continued. The shares have recently bounced back and are a few points below the all-time high.

They are also slightly above the 25-day and 50-day exponential moving averages. Therefore, I suspect that the shares will continue the bullish momentum as investors attempt to move above the all-time high of $322. A move above this level will see the stock jump to the next psychological level of $350.

Where to buy right now

To invest simply and easily, users need a low-fee broker with a track record of reliability. The following brokers are highly rated, recognised worldwide, and safe to use:

- Etoro, trusted by over 13m users worldwide. Register here >

- Plus500, simple, easy to use and regulated. Register here >