The Nio (NYSE: NIO) stock price darted higher on Tuesday even after the company published weak May delivery numbers. The stock rose by more than 9% and ended the day at $42.34, valuing the Chinese electric vehicle company at more than $52 billion.

Nio deliveries slide

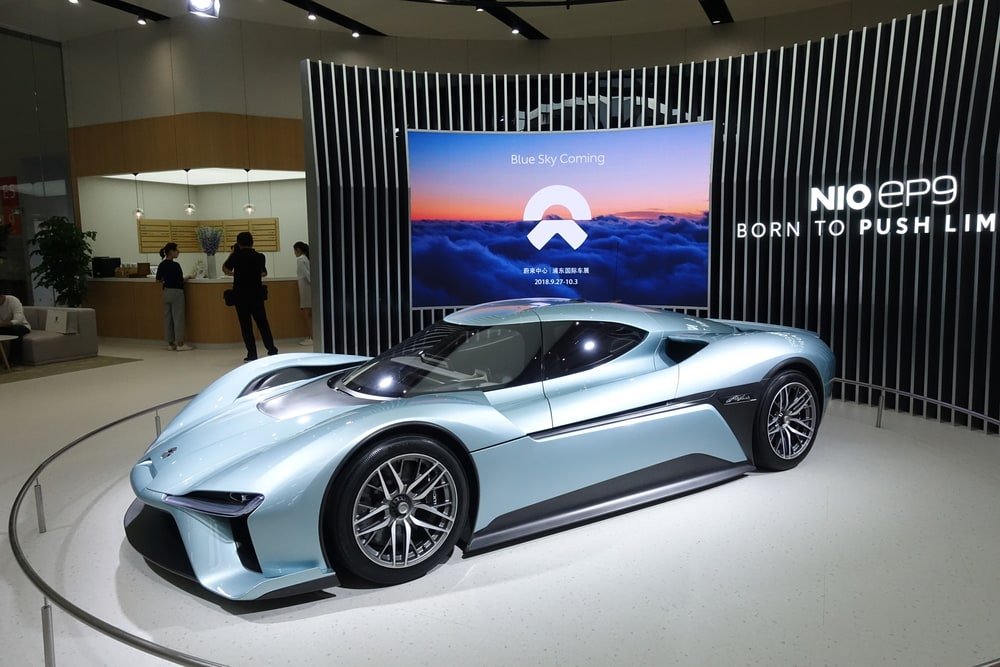

Nio is one of the largest Chinese electric vehicle companies. The company sold more than 43,728 vehicles in 2020, an excellent performance for a company that started selling cars in 2019.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

In a report on Tuesday, the company said that it sold 6,711 cars in May, up by 95% from the same month in 2020. The sales dropped by 5.5% from the previous month in what the company attributed to the ongoing semi-conductor shortage. It sold 1,412 ES8s, 3,017 ES6s, and 2,282 EC6s. The company hopes to sell between 21,000 and 22,000 cars in the second quarter.

The Nio stock price rose after the relatively weak deliveries for two primary reasons. First, in a statement, the company expects to compensate for the sales it lost in May this month. Also, Nio is not the only automaker struggling to find chips. Other companies like Volkswagen, Tesla, BMW, and General Motors have all lamented about the chip shortage.

Second, the stock jumped after a critical analyst changed tune. In a note, Jeff Chung of Citi upgraded the stock to buy from hold. He had downgraded the stock from buy to hold in January. He expects that the stock will jump to $58, which is about 38% above the current level.

Other analysts are relatively bullish on the stock. Those at Mizuho expect that the Nio stock price will rise to $68 while those at Deutsche Bank see it rising to $60. Those at HSBC and Morgan Stanley expect it to rise to $80, which is about 90% above the current level.

Nio has struggled

Nio stock price has struggled lately. After soaring to an all-time high of $66.7 in January, it fell by more than 35%. This decline is mostly because of the overall decline of EV companies. Indeed, shares of other EV companies like Lordstown Motors, Tesla, and QuantumScape have all fallen by double digits.

Similarly, the stock has fallen because of the strong competition it is facing in China where hundreds of automakers are trying to gain share. Some of the best-known competitors in China are BYD, Tesla, and Li Auto. In a note today, Li Auto said that its sales declined by 22% month-on-month in May.

Further, the stock has dropped because of the ongoing fears of high-interest rates that have affected high-growth stocks.

Nio stock price analysis

The daily chart shows that the Nio stock is attempting to bounce back after forming a double-bottom at $31.75. In technical analysis, this is usually a bullish pattern. It has also moved above the 25-day and 50-day exponential moving averages (EMA), which is also a bullish signal. Therefore, the pair may keep rising as bulls target the year-to-date high of $66.2.

eToro

7/10

67% of retail CFD accounts lose money